I feel that “outgroup dumb” is shitposting but it’s from a real poll.

https://today.yougov.com/politics/articles/5057-understanding-how-marginal-taxes-work-its-all-part

Where i live we have a system where if you take sick days, they are paid 80%. 20% reduction applies only to the days you were sick. Once I got sick at the end of a month and took the last 3 days of the month and first 2 days of the next one off and my mother in law freaked out I’m about to loose 20% of 2 month’s salaries. She was and is still convinced that 20% deduction applies to a whole month worth of salary even if you take one day off that month. She almost never takes sick days and she works in a hospital… She self medicates and works with patients even when she has a transmittable diseases. Best of luck to those who have serious health problems and then get a fucking flu on top of everything from hospital staff. She is 60+ and reading the law to her doesn’t change her mind. A couple years ago she had more serious health problems and took a week off for the first time in decades, even after getting a paycheck reduced only by 5% and not 20% her perception of this issue didn’t change. She misunderstood that system once 40 years ago and she is going to take that misunderstanding to ger grave. Real world has no influence on her beliefs.

This is absolutely an educational failing. We barely cover taxes in school. At best it’s said once in a class, gets covered in a minor question on a test and if we get it wrong, no one notices. “We” probably still got a B on the test without any CLUE how taxes work.

Yet here we are, dismantling any nationwide effort to make education better.

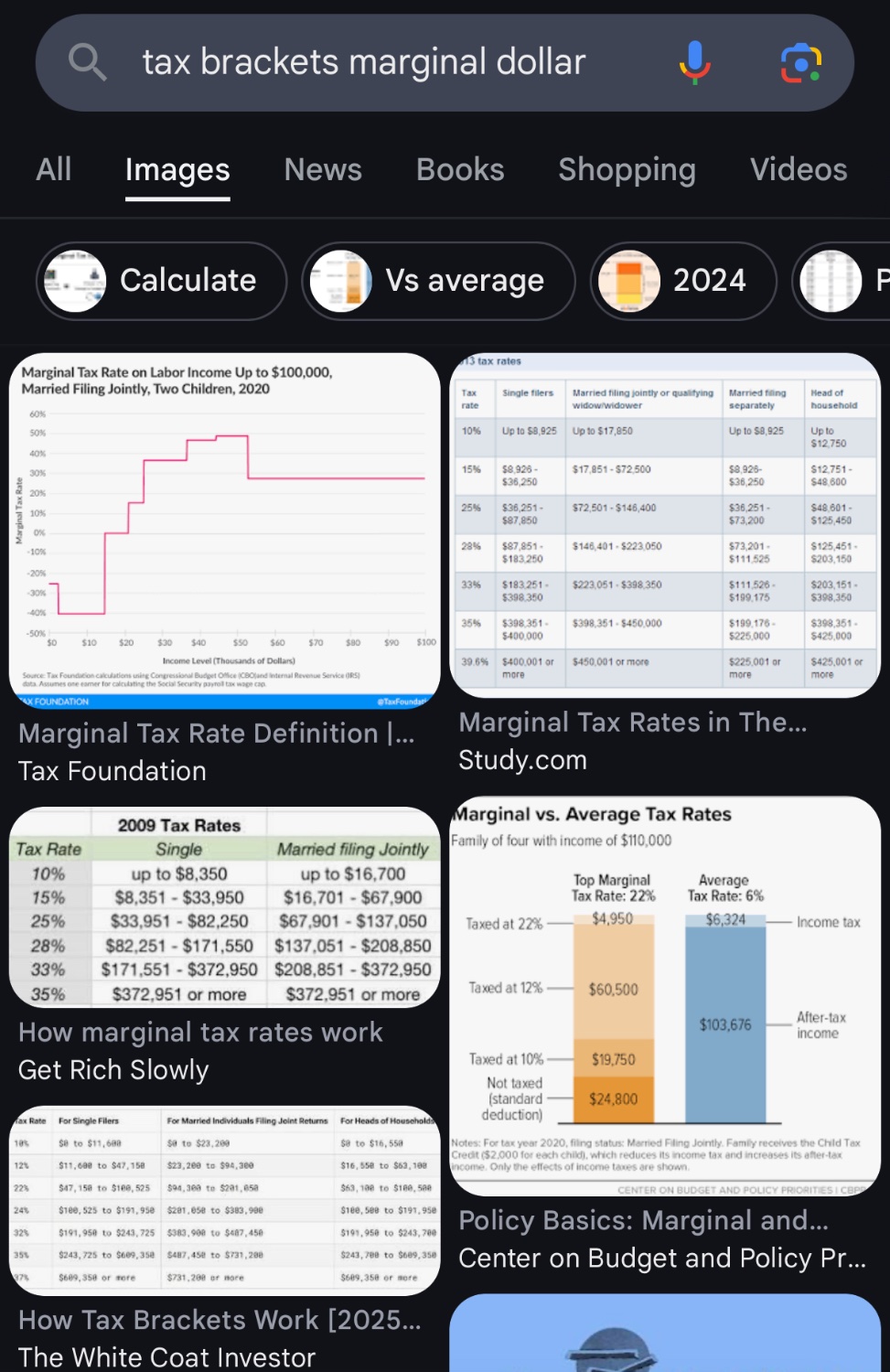

A LOT of people think 99,999 tax is 27,999 and 100,001 is 29,000, even on the democrat side. If those charts are accurate, it’s probably damn close to 50% of US citizens.

I seriously don’t understand why we don’t have a mandatory class that covers taxes, T4 slips, investing, labour laws, budgeting, reading nutritional information on foods, etc.

The nutritional stuff is like 5th grade science, about the time you should be burning peanuts with a bunsen burner.

I’ve seen a few schools that have an elective financials class. But I think they’re still trying to balance checkbooks.

The problem is it’s just one class and nobody takes classes seriously in high school. Most of them have forgotten the things that they used to know when it gets 20 30 40 years past there education.

It’s like we need some kind of driver’s ed test but for living

I’m just in awe about those 28% and 33% tax brackets. I’m in the 49,5% bracket here in The Netherlands. That being said, I’m fortunate to be in it.

When you are talking large income to larger income, that makes total sense, but are there limits for access to things like child tax credits where if you go over you are no longer eligible, causing significant increase (I just looked, and it’s at $200k single of $400k jointly, so unless you have A LOT of children, I suppose there wouldn’t be a huge effect)? Similar to people on government assistance who go from getting full assistance to getting nothing at a certain income level?

This is a big factor. A lot of people conflate less benefits with higher taxes because fear-brain just knows they both equal increased hardship in the end. They’re technically wrong but their statistically slightly more active amygdalas are responding to a genuine threat, just one that they’ve been very skillfully misdirected into helping worsen.

So an indoctrinated fear response that create a policy advantage for the very elites who created it.

Wow humans are so nice

tbh the more I learn and experience that’s most of the human experience. I had a Minister when I was young that said there’s really only two human emotions, fear and love, and that without significant intervention fear pretty much always wins. I’ve been working in psychiatry for almost a decade now and there’s lots of finer points to be made about human psychology but in the end it pretty much all does just boil down to fear and love.

He was an exceptionally good Minister, to the extent that for while I didn’t understand how common it was for people to be deeply betrayed by a church leader. It was not uncommon for people in the community to genuinely compare him to Fred Rogers (who was incidentally also a Presbyterian minister). Very similar background, temperament, points of advocacy, and even appearance and mannerism; if they hadn’t both been alive at the same time it almost might make me believe in reincarnation.

No source?

Don’t need one. The amount of times I’ve had to explain how fucking tax brackets work, I wouldn’t be surprised if the numbers were even more skewed towards the wrong answer.

This is how missingormation spreads though. If something lines up with your existing worldview then you just assume it’s true.

Trust but verify

Lol no. Verify then trust

Oh, you know: Tomato tmahto, potato criptofacism.

And this why democracy won’t work. How can people votw in their best interests when they don’t know how basic taxes work

even if people were mega geniuses it wouldn’t matter, money talks, and it talks a lot louder than people

This belief is held by many older folks due to propoganda, and it is passed down to their children when their parents teach them about taxes. Since almost all younger folks use automated tax services, if they aren’t doing the math themselves, the fact that this isn’t true isn’t going to be discovered. I was taught the incorrect way when I was a kid, but noticed that it was wrong the first time I had to do my own taxes. But when I told my parents the way it actually worked, they didn’t believe me until I showed them the .gov site that breaks it down. I grew up in a small, blue collar town, and every single person I talked to about taxes parroted the same incorrect system.

Thanks, Lemmy, now I’m “that Dad”. After reading this, I went to dinner with my two teens and one of their girlfriends, so of course I had to bring this up. All three have started working after school and will need to file their taxes this year so they need to know.

But holy crap is that a seriously uncool conversation

lol i wonder how much that is just guessing. they just coin flipped it

Tell me you don’t know how income taxes work without telling me you don’t know how income taxes work.

My question is who does their taxes then?

A lot of people don’t know anything about taxes and have their tax return done by an accountant, even if their situation is extremely simple (works one job, no taxable investments or capital gains, no investment properties, no foreign taxes paid).

Even if they did go through the trouble to do their own taxes, the IRS specifically instructs taxpayers to not calculate it themselves, but rather to use a “tax table” to lookup their income and next to it is listed their income tax amount.

What a fucking stupid, needlessly complicated and not accessible system

That’s the point

How dumb do you have to be? By the time you make that much money you should, in theory, know the answer definitively or have a guy.

Almost everyone has a guy or uses some software. Those two things don’t help them understand and this misconception of how taxes work is but a small sample of how people form political decisions without any viable understanding of the situation they’re in or the repercussions of their actions.

Nobody’s just making out a check for 30% and mailing it off to the IRS.

This is the problem. My partner doesn’t want to work OT because he thinks it will cost him more in taxes. I explain why that’s not exactly true, but I can tell he’s not interested. Financial Literacy in the US is abysmal.

it’s just not the US. I live in the Netherland and many people here think OT and bonuses are taxed differently, because they see a higher tax rate applied to it on their slip. They forget that their base salary covers multiple brackets and a tax credit. Thus has a lower average tax rate than their OT and bonuses which falls in their top bracket or even a bracket above.

Tbh, literacy in the US, financial or otherwise is abysmal right now.

This is not a US specific issue, tbh. I’ve heard this weird belief repeated by all sorts of people.

it is a misinformation many people in power wants to keep because it lets republicans sell their policies to not tax the rich and bosses to not raise their employee’s salaries.

You’re absolutely right. I cant speak for anyone else, as I don’t live there but I highly doubt the US is an exception.

Rather than being mad at each other, I want to make sure we hold the right people accountable! Governments, corporations, billionaires etc.

It’s a form of oppression.

I’ve heard it in Australia too, which has the same tax bracket system as the USA. I think the fact that this stuff isn’t taught in school is a major issue.

I’ve had jobs (more than one), where working OT would result in my paycheck take home pay being less than if I had not worked the extra hours. And that’s because it moved me into the next bracket, and more taxes were taken out. So why waste my time working OT?

That’s not how is works though.

I’d you made say 1500 normally and 2000 with ot your take home could be 1200 and 1400. Paying more taxes overall on the ot but still taking home more.

There is no way you’d take home less money because taxes are paid on the first $1500 @ $300 and say the next $500 @ $300 too at a higher bracket. Overall your pay is still higher though even though your taxes “doubled”.

Well, it has happened more than once. Of course it would depend on the amount of overtime I worked. It probably happened if I only worked a little OT.

That’s not how it works though. Unless you didn’t work regular hours during that same time period so worked less overall OT is taxed higher upfront so you don’t end up owing (more), but would never decrease your pay

But it did, more than once. Its been years since it happened though. I cant remember the amount of OT I worked that caused it.

I think you’re on the wrong side of the chart here.

Or the person calculating their withholding was. But if you’re paycheck to paycheck then that paycheck amount is all that really matters. Cool, I get a bigger refund eventually, but I’m now choosing between eating, walking 2 hours to work to save gas, or letting a bill go unpaid.

Your partner is a moron who doesn’t understand relatively simple math.

Nah. He’s not an idiot. But he is impatient. He doesn’t handle paperwork or anything involving patience well. (ADHD)

I also think taxes in the US are intentionally over complicated and confusing. I don’t struggle with things like that but I can empathize with people who do.

I too have ADHD and am impatient (combined type, severe). Impatience is not an excuse for financial illiteracy. And a graduated income tax is not complicated. Deductions, credits, exceptions, etc are where it gets complicated. But if he thinks he’s losing money by making more money, then he’s stupid.

Reading your other responses, you’re right. Not knowing something doesn’t make someone stupid. Refusing to learn something when you find out you don’t know it, that’s what makes someone stupid. Willful ignorance is stupid.

At the very least, he should just admit he knows nothing about it and just take your word for it. Deferring to others expertise in areas you are weak is smart.

Strictly speaking the taxes in the US are not that complicated, but the credits, deductions and what not are. Still Tomato Tomato.

have you considered asking him why he even thinks that in the first place? You’ve literally put him into a spot where he’s too stupid to even care about whether or not that response is logical or makes sense.

If he just doesn’t want to work overtime that’s fine, a lot of people don’t, why would he justify it with stupid tax logic that he evidently must know is stupid? Seems like cope to me.

You cannot simultaneously “be smart” and then “be stupid” you are either stupid about something, or not. It’s one of the two. I’m sure he’s a pretty generally smart guy, most people are, but either it’s an excuse he uses because he doesnt want to work overtime, or he’s literally uneducated (and therefore stupid) about taxes, and chooses not to be educated about it, even though it would be financially beneficial to him, because that’s literally how money works. (which would also make him pretty objectively stupid in that case) again, he may not care at all, but then why wouldn’t he just be upfront about not caring?

I would disagree with your premise but it’s not your fault. It’s my fault for not explaining it clearly

I don’t think not knowing something makes you stupid. Humans can’t know everything. We all have strengths and weaknesses. I know about taxes, but I don’t know shit about cooking. He cooks dinner, I deal with the bureaucracy situations.

Also, I’m don’t know if you’ve ever spent time with someone who struggles with ADHD and Neurodivergence but their brains don’t work like others. They can’t force themselves to do things that other people can tough out. They can study all night but if their brain can’t stay on track, they won’t be able to retain it.

When I come along and start telling him how tax brackets work, especially if he didn’t ask me, hes going to be frustrated and he’s not going to get through it easily.

I don’t know if he just doesn’t want to work OT and has settled on this excuse or if there is some other issue but it doesn’t matter. If he doesn’t want to work OT, that’s okay!

There’s not enough information provided to reach this conclusion.

There is very much enough information given to reach that conclusion.

No, there is not. There are many tax credits one is no longer eligible for after a certain threshold. There are various programs one is no longer eligible for after a certain threshold.

Most of the likely credits tend to phase out gracefully. So it’s true that we can’t be certain, based on my experience of when people are afraid of making too much money, it’s almost always because they think a higher tax bracket applies flatly across their income not due to nuanced understanding of tax credit and welfare benefits.

This is true for many people I’ve talked to, but he does understand, on a basic level, how the brackets work. When it comes to the calculation parts, I think he gets frustrated with all the rules.

But it’s okay! I’m good at stuff like that and he can build pretty much anything. We all have our strengths. :)

Hellllll yeahhhh!!!

Yooo is he visual?

Awww I thought for sure we were gonna have the perfect diagram thing…

Bah. So maybe there’s some YouTube video where they’re like “Bob made $50,000 last year. This year he took some extra construction shifts and made $75,000. …”

I don’t care about the partner’s weaknesses I demand clever solutions :p hehe glad everything is good!! 💙

Edit with silly riff that’s probably inaccurate:

I’m kiddddding this was just the evil thought when I first read it :p

“you can’t make less money by making more money”

Unless you’re poor enough to be on welfare. The Welfare Cliff is awful.

This can also apply to student loans when one person makes a lot more than the other.

Oddly enough it kinda does. OT can make you pay out more taxes on that one check since withholdings are calculated by check. Basically the government/payroll system thinks you’re going to be making that every week so more taxes will be taken out.

In reality this only effects the size of your tax bill or return at the end of the year.

That’s what people see and exactly why they think they got kicked up a whole tax bracket.

The whole notion of “kicked up a tax bracket” is also a misleading thing. Only a piece of your income goes into the “new bracket”, all pay under the new bracket is taxed as they would have been used to.

Exactly, and it also depends on what withholding you have requested.

Run, if it’s not too late.

Nah. There’s good people here and even the people who voted for this deserve to have their needs met, many of then are only personally responsible for a tiny fraction of the immense harm caused by the systems of power. And they may not have caused any harm if they lived in a place where people are always taken care of as well as is reasonably possible. there is immense pressure to shed empathy and embrace individualism and forego the many benefits of community such as efficient and effective collaboration, for example to prevent a disease from spreading or at least reducing the harm it causes. As many of us can see, especially obviously in the US, the goal and function of the system isn’t actually to stop causing harm in the first place, or even reduce the harm that must be caused for your society to function, the cruelty is often very much the point. Non-absolutely essential needs are less and less profitable to meet the less common it is to have the need, and the amount of wealth that can be extracted from the people with whatever need is the only thing that really determines what gets things done, and subjugation and not giving folks a chance to think critically and question their circumstances by completely overwhelming them with horrible information (including dis- or misinformation) about the world and making them think they’re threatened by whoever is opposing efforts to make line go up. Most folks don’t stand a chance without direct intervention and time spent with someone directly affected by the system in an obvious way, including possibly the person themselves.

At the very least I owe it to my family to stay and be as helpful as possible to the people who have supported me and hopefully others who don’t deserve what’s coming if a major effort of community organization doesn’t happen

We all have our weaknesses and faults. No need to dismiss every relationship due to imperfections.

Nah. He’s not a bad person or a dummy. He just gets frustrated by bureaucracy and doesn’t have the patience I have.

It’s not the fear of bureaucracy that is concerning, it’s the lack of interest to listen to your sound advice on a relatively simple topic.

That’s fair. I appreciate your concern for me!

He’s not always like that. I didn’t mean to make him sound like a jerk. I just meant to relate to the topic of tax confusion with personal experience.

He had pretty severe ADHD and struggles with some topics. It’s okay! I deal with the money stuff and he cooks dinner. :)

Fair enough. Good luck on your journey!

You too!

By design

No, they teach you this in high school. These people are just dumbasses

Yeah, I definitely didn’t leave this in school. I know about it from reading articles on tax brackets. _(‘’)/

Yes, everyone’s education is the same as yours.

For someone outside the American tax system, can anyone put the difference in approximate numbers?

This all boils down to a common misconception about ‘tax brackets’.

To simplify, pretend there’s a 28% tax bracket up to 100,000 dollars, and a 33% tax bracket when you hit 100k. The first 100k is always taxed at 28%, no matter what you make, and it’s only the incremental amount that gets taxed heavier. So here in this example, that would mean tax burden would be 28,000.33 instead of 28,000.28. These are not the exact brackets or percentages, but it’s at least showing the right magnitude of increase versus total amount.

However, many people are “afraid” of bumping a higher tax bracket. They think the tax bill would go from 28,000.28 to 33,000.33. That the tax bracket bumps up all your liability. I remember growing up people saying “I have to watch out and not hit the bigger tax bracket, if I’m close then I need a big raise to make it worth it, or else the raise is going to cost me more than it would make me”. This a big driver of antipathy toward democrat tax policies, a belief that mild success will punish them, despite it only increasing on the incremental amount.

We took a huge hit in our coat of living when we fell off the benefit cliff. I know it’s lost credits rather than more taxes but it doesn’t really matter when you make more and struggle at least as much as before.

A lot of US benefits have “benefit cliffs” where making $1 more substantially reduces or even completely disqualifies a person from programs like SNAP (food stamps) or childcare subsidies or Medicaid. https://www.ncsl.org/human-services/introduction-to-benefits-cliffs-and-public-assistance-programs

It’s not surprising people whose families are directly affected by, or who know people affected by, benefit cliffs think the lawmakers set up taxes the same way.

True, though if we are talking about tax bracket going over 30 percent, that would be at nearly 200k, so well above those thresholds too. Of course the numbers aren’t 28 and 33, but that is the closest threshold to the example.

German income tax works the same and most Germans get it wrong too. It’s really infuriating.

To be more specific the first 100,000 isn’t taxed at 28%. The 44 to 100k range would be, but below that will be taxed at lower percentages. The first ~10k you make is taxed at 10%, and then it increases throughout.

If getting specific, there’s no 28 percent or 33 percent bracket, so these are all examples rather than real figures. I did make a comment using real numbers, same general magnitude but just more specific about the brackets.

The first ~10k you make is taxed at 10%

In the USA, technically the first $15,000 (if single) or $30,000 (if married and filing jointly) at least is taxed at 0% due to the standard deduction. If you earn less than that, you can tell your employer that you don’t want any tax to be withheld.

OK, so it is similar to our system. And would probably in the range of cents or a few dollars then.

In exact numbers, 5 cents.

That one dollar in the 33% bracket has .33 in taxes instead of .28. So their obligation goes up .05 per every dollar in the 33% tax bracket.

Your local tax system probably works the same.

It boggles my mind how many people who have had to pay taxes for decades even, don’t understand how tax brackets work.

The only time you’ll get screwed on making more is if you were getting some sort of socialized assistance and you make a dollar over the cut off for aid.

Yeah, the Welfare Cliff is the only place where this happens and it’s unconscionable.

It is kind of by design to keep people from trying to get ahead at all

And to keep the private tax filing agencies afloat

And they’ll also refuse to believe you when you try to explain it to them